(BISMARCK, ND) – Politicians are known for contradicting themselves, but their flip-flops usually don’t cost over one trillion dollars.

Kevin Cramer’s latest flip-flop does. And if he gets his way, North Dakota taxpayers are going to foot the bill.

For more than a decade, Kevin Cramer decried the national debt, calling on members of Congress to cut spending, eliminate programs that benefit North Dakota, and rein in deficits.

Now it’s 2017, and the Republican-controlled House of Representatives has accomplished few – if any – major policy goals. In Cramer’s own words, Republicans are fighting for their “political survival” unless they pass something into law. Anything. Deficits be darned when Republican mega-donors are angry.

That something, it seems, is a massive budget-busting tax bill that benefits the wealthy at the expense of low- and middle-income families in North Dakota, who in many cases would actually see a tax increase.

“If cutting taxes for the wealthy and hiking taxes on many low-and working-class people wasn’t bad enough, Kevin Cramer didn’t even bother to pay for the bill,” said Democratic-NPL executive director Scott McNeil. “What happened to the Kevin Cramer who was constantly sounding alarms over the national debt when we had a Democratic president? Did he forget about Congress paying its bills? Or did he never really care to begin with? His tax cuts for the wealthy are just another example of Cramer putting party and politics before North Dakotan families.”

Timeline of Cramer’s statements on the deficit and debt leading up to his $1.3 trillion two-step:

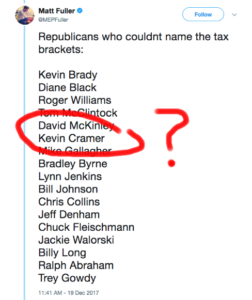

November 16, 2017: Despite more than 10 years of statements to the contrary, Cramer disregards the national debt and votes in favor of a massive tax bill that threatens to stick taxpayers with a $1.3 trillion bill.

…but before that…

September 26, 2016: According to the Bismarck Tribune, “Cramer, 55, is seeking his third two-year term in Congress. He said he has worked with fellow lawmakers to reduce the federal deficit.”

January 16, 2014: According to Underwood News, “Cramer agreed: ‘We should be diligent with every penny,’ he said. Cramer added that the national debt will never get under control until entitlements are dealt with.”

October 7, 2013: According to the Williston Daily Herald, “Looking ahead, Cramer said the key to ending the shutdown is leadership and compromise. ‘Funding decisions are not easy with the national debt approaching $17 trillion,’ Cramer said.”

November 7, 2012: According to the Associated Press, “Cramer advocated eliminating a federal tax subsidy for the wind industry to help reduce federal budget deficits and debt.”

September 29, 2012: According to the Grand Forks Herald, “Cramer acknowledges the job losses linked to the expiration but said North Dakota’s economy is strong enough to absorb them. The national debt should be a bigger concern than support for the wind industry, he said. ‘Is that really the appropriate role for our government, to subsidize jobs when we have a $16 trillion debt?’ he said.”

March 14, 2010: According to the Bismarck Tribune, “For Public Service Commission Chairman Kevin Cramer and Fargo legislator and businessman Rick Berg, the economy, job creation, energy and health care have been major issues of the campaign. Both consider the economy and job creation to be priority No. 1, both are opposed to the health care bill and cap-and-trade, and both want to tackle the deficit.”

May 3, 1998: According to the Bismarck Tribune, Cramer expressed concern over “feeding the federal budget.” “Cramer – who had indicated this might be a kinder, gentler campaign than he waged two years ago – set the tone by saying, ‘It seems Earl is not concerned about the take-home pay North Dakota workers need to feed their families. He’s more concerned about feeding the federal budget.’”

April 16, 1996: According to the Bismarck Tribune, Cramer “renewed his call for another amendment, this one to require Congress enact balanced federal budgets. Raising taxes won’t eliminate the federal deficit, he said, but that amendment would.”